people's pension higher rate tax relief

You will automatically get tax relief at 20 on your pension but if you pay higher rate income tax its up to you to claim the rest. Unfortunately higher rates can create economic pain for Americans by making it more expensive to borrow money.

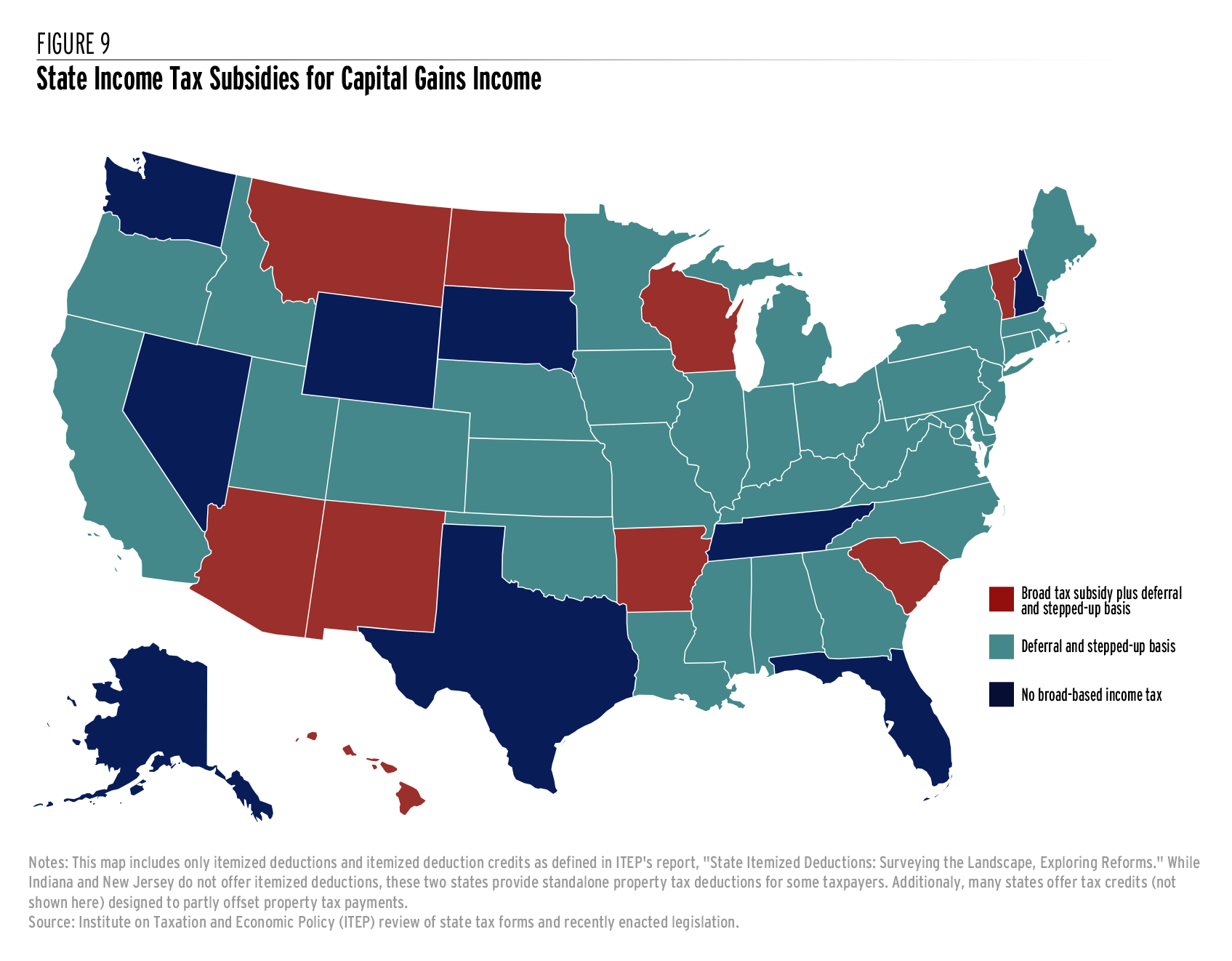

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Additional-rate taxpayers with an annual income.

. Therefore individuals in the higher rate of income tax payment receive an additional 20 tax relief while those in the additional-rate tax payment band of income tax. The first batch of direct payments also called inflation relief checks is set to go out on Oct. The additional amount of tax relief you can claim is.

You put 35000 into a private pension in that tax year. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. Hargreaves Lansdown has calculated that a higher earner paying 40 per cent tax and currently making pension contributions of 10000 a year will be 1500 worse off under a 25 per cent.

It was founded in 2000 and has since become an active. Tax relief on pension contributions for high earners. A contribution of 100 from your salary into your pension would cost you 80 with the government contributing the other 20.

How does higher rate pension tax relief work. Yes the value of leave donated in exchange for amounts paid before January 1 2021 to organizations that aid victims of COVID-19 is excludable from an employees income for. Tax relief is linked to the highest band of income tax you pay.

You can claim 20 extra tax relief. Basic-rate taxpayers get 20 pension tax relief. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

The combination of paying more tax and coping with a cost of living crisis could force millions of households to the brink. An individual who earns up to 75000 a year would receive a 350 refund which would double to 700 for joint filers earning as much as 150000. How much income tax you pay depends on what band you fall into.

You can claim an extra 20 tax relief on. About the Company Pensions Higher Rate Tax Relief. Specifically the amount of extra tax relief you can claim depends on how much you earn over the higher rate tax band currently 50270.

A basic rate tax relief of 20 is automatically applied on the whole amount. 7 the Franchise Tax Board said. 20 up to the amount of any income you have paid 40 tax on 25 up to.

Higher-rate taxpayers anyone earning over 50000 per year receive 40 tax relief. This means that if youre a higher-rate or an additional-rate taxpayer you could claim extra tax relief on top of the basic 20. On 23 March which has been dubbed tax day the Treasury will announce new consultations on proposed taxation reforms which could include reforms to pension tax.

The Fed raised its benchmark rate by three-quarters of a. Since the plan to send millions of Californians. Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45.

If you are a higher-rate taxpayer you could reclaim an additional 20 tax on your pension contributions for a total of 40 tax. The threshold for higher rate tax is.

Self Employed Pension Tax Relief Simple Guide To Pensions Jf Financial

Tapering Of Annual Allowance For High Incomes Royal London For Advisers

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

9 States With No Income Tax Kiplinger

Remember Your Pension In Your Self Assessment

The State And Local Tax Deduction A Primer Tax Foundation

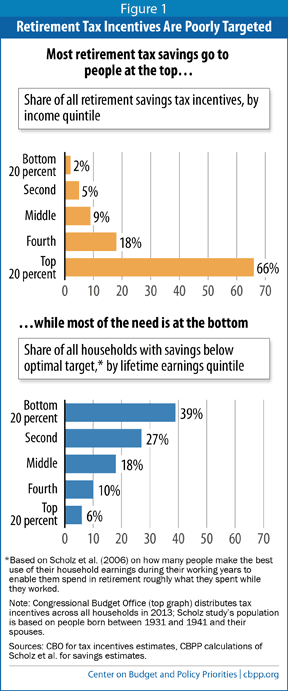

Who Benefits More From Tax Breaks High Or Low Income Earners

Five Tax Threats To Your Pension Financial Times

How Large Are The Tax Expenditures For Retirement Saving Tax Policy Center

Taxation In Aging Societies Increasing The Effectiveness And Fairness Of Pension Systems G20 Insights

Guide Pension Carry Forward Evelyn Partners

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

High Rate Pensions Tax Relief Faces Axe

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How Do Pensions Work Moneybox Save And Invest

Retirement Tax Incentives Are Ripe For Reform Center On Budget And Policy Priorities

Do You Know How Tax Relief On Your Pension Contributions Works Low Incomes Tax Reform Group

Taxation In Aging Societies Increasing The Effectiveness And Fairness Of Pension Systems G20 Insights